Apply For Finance

We can consider the following

*Working Full-Time.

*Working Part-Time.

*Self-Employed.

*Currently Not Working But Receiving Benefits.

*Unable To Work On Disability Benefits.

*Retired With Pension.

*Semi Retired With Income.

You need to be able to

*Show that your NOT struggling to support yourself.

*Show proof of where you have lived or where you are living.

Some good points to take in

*We can take a part-exchange vehicle to lower the payments.

*We DO NOT charge any setup fees or commission.

If you need reserve a vehicle

Why not consider putting down a deposit of £100 non-refundable to secure the vehicle - You must have a payment contract in place & the vehicle must be collected within 7 days.

If a payment contract hasn’t been agreed & signed by both parties & the vehicle not collected within the stated period! The vehicle will be re-advertised & any deposit previously paid is non-refundable.

We Might Be Able To Help

Excellent/Good Credit Rating:

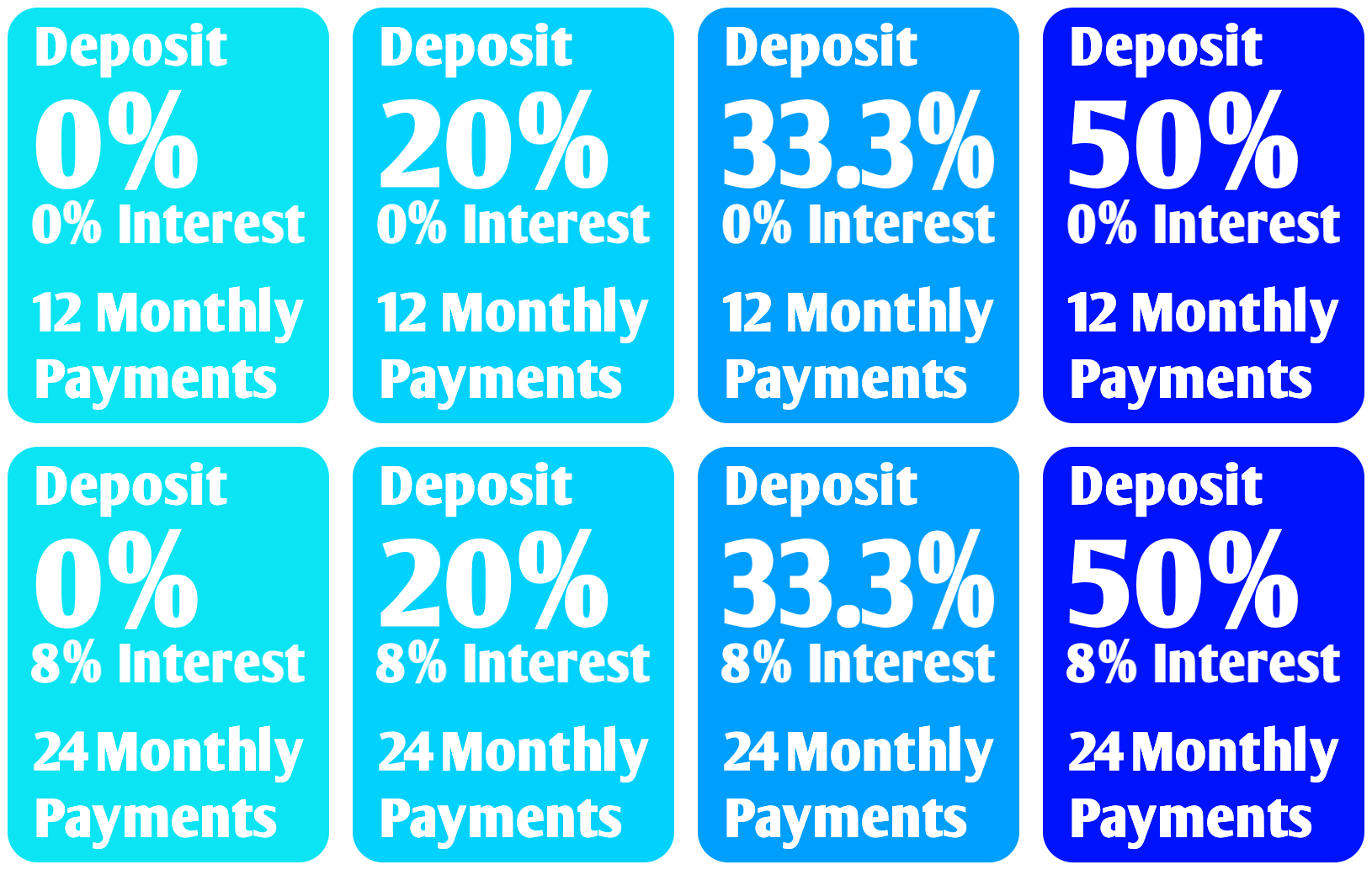

Deposit will be optional with 0% interest over 1 year on the balance payments & 8% interest charged over 2 years on the balance payments.

If you can meet the deposit required & meet the balance payments each month! Also making sure you can gather all the necessary paperwork we require!, Just complete the form at the bottom to start the process.

Good/Fair Credit Rating:

10% or 20% deposit is required with 0% interest over 1 year on the the balance payments & 8% interest charged over 2 years on the balance payments.

If you can meet the deposit required & meet the balance payments each month! Also making sure you can gather all the necessary paperwork we require!, Just complete the form at the bottom to start the process.

Bad Credit Rating:

33.3% or 50% deposit is required with 0% interest over 1 year on the the balance payments & 8% interest charged over 2 years on the balance payments.

If you can meet the deposit required & meet the balance payments each month! Also making sure you can gather all the necessary paperwork we require!, Just complete the form at the bottom to start the process.

Getting Your Paperwork Prepared

Banking & credit card statements online

If you do online banking, Your bank statements & credit card statements are available to download as PDF files, Have a look on your online bank accounts for this option. We can accept these files sent through email rather then you having to print these all off.

Banking & credit card statements by post

If you don't do you're banking online! bring the original paper copies that your bank & credit card company sends to you.

Letters & other utility bills

Bring the original letter copies, These will then be copied and kept on file by us.

*See paperwork required below.

Affordability Calculator

You will need to complete the "Affordability Calculator" at the bottom of this page.

*Do this when you have all your paperwork sorted.

Paperwork To Bring With You

We need as much of the paperwork you can provide.

#1). You need to show proof that your not struggling to support yourself.

#2). You need to provide solid evidence of where you are living.

We need to see at least 60% to 80% of your paperwork/evidence to be able to make a judgement.

What you will need to bring with you

Anything highlighted (Bold) below is a minimum requirement

Example - Household bills i.e. Electric/Gas/Water & Broadband/Landline/Telephone.

Example - Letters i.e. Council TAX Statement (If possible) & Rent / Mortgage.

Example - Other Letters i.e. Any insurances letters or anything similar.

#1). I:D Driving licence & Passport (2x forms of I:D if you have both).

#2). You need to provide a minimum of 3x household bills in your address.

#3). You need to provide a Council TAX statement (If possible), This would make a huge difference (Outcome).

#4). You need to provide a rent or mortgage letter/contract in your address.

#5). You need to provide any wage slips if you have any.

#6). Bank statements for the last 3 months & your last credit card statements.

#7). You need to provide at least 2x of anything that is historic (as old as you can find), These can be old household bills/Tesco club card etc in your name & address's of where you have lived at any time (This is to show that you have a passed life existence of more than 3 months).

Cross-Check: 2x forms of I:D (If available), 3x Current household bills, 1x current council tax statement (If possible), 1x current rent or mortgage letter/contract, Any current wage slips if you have any, Bank statements for the last 3 months, Last credit card statements, 2x anything that is historic (as old as you can find) in your name & address's (This is to show that you have a passed life existence of more than 3 months).

Agreement & Payment

Sale Agreement & paperwork

Once the sale is agreed, The paperwork will be processed & will be ready to be completed by you the next day.

Forms you will need to complete & sign

#1). Section 1.1 (Receipt Of Sale).

#2). Section 1.2 (Payment Plan).

#3). Section 2 (Sale Agreement).

#4). Vehicle as Described (Questionnaire).

#5). Payment Agreement.

#6). Terms & Conditions.

Payments

All deposits & monthly payments are paid through your bank account. You can either set up a standing order or do this manually.